1. General Information

The proposed creation of the National Asset Management Agency was announced in the Minister for Finance’s Supplementary Budget on 7 April 2009 and the Act was passed in November 2009.

The Act established NAMA as a separate statutory body, with its own Board and Chief Executive Officer appointed by the Minister for Finance, in December 2009.

The main purpose of NAMA is to acquire assets in the form of property related loans from credit institutions which were designated by the Minister for Finance as Participating Institutions under Section 67 of the Act. The original Participating Institutions were: Allied Irish Banks, p.l.c. (‘AIB’), Anglo Irish Bank Corporation Limited (‘Anglo’), Bank of Ireland (‘BOI’), Irish Nationwide Building Society (‘INBS’) and EBS Building Society (‘EBS’).

On 1 July 2011, AIB merged with EBS. On 1 July 2011, the business of INBS transferred to Anglo and on 14 October 2011 the latter’s name was changed to Irish Bank Resolution Corporation (‘IBRC’). IBRC was subsequently liquidated on 6 February 2013. On 7 February 2013, the joint Special Liquidators were appointed under the IBRC Act 2013 and assumed the role of the primary servicer, and with effect from 12 August 2013, the role of the primary servicer of NAMA loans in IBRC is being fulfilled by Capita Asset Services (‘Capita’).

On 22 September 2014, the case management for BOI NAMA loans transitioned to Capita, and from 23 February 2015 a full transition (excluding residential loans) has been made with Capita maintaining the system of records for loans originally acquired from BOI.

1.1 National Asset Management Agency Group

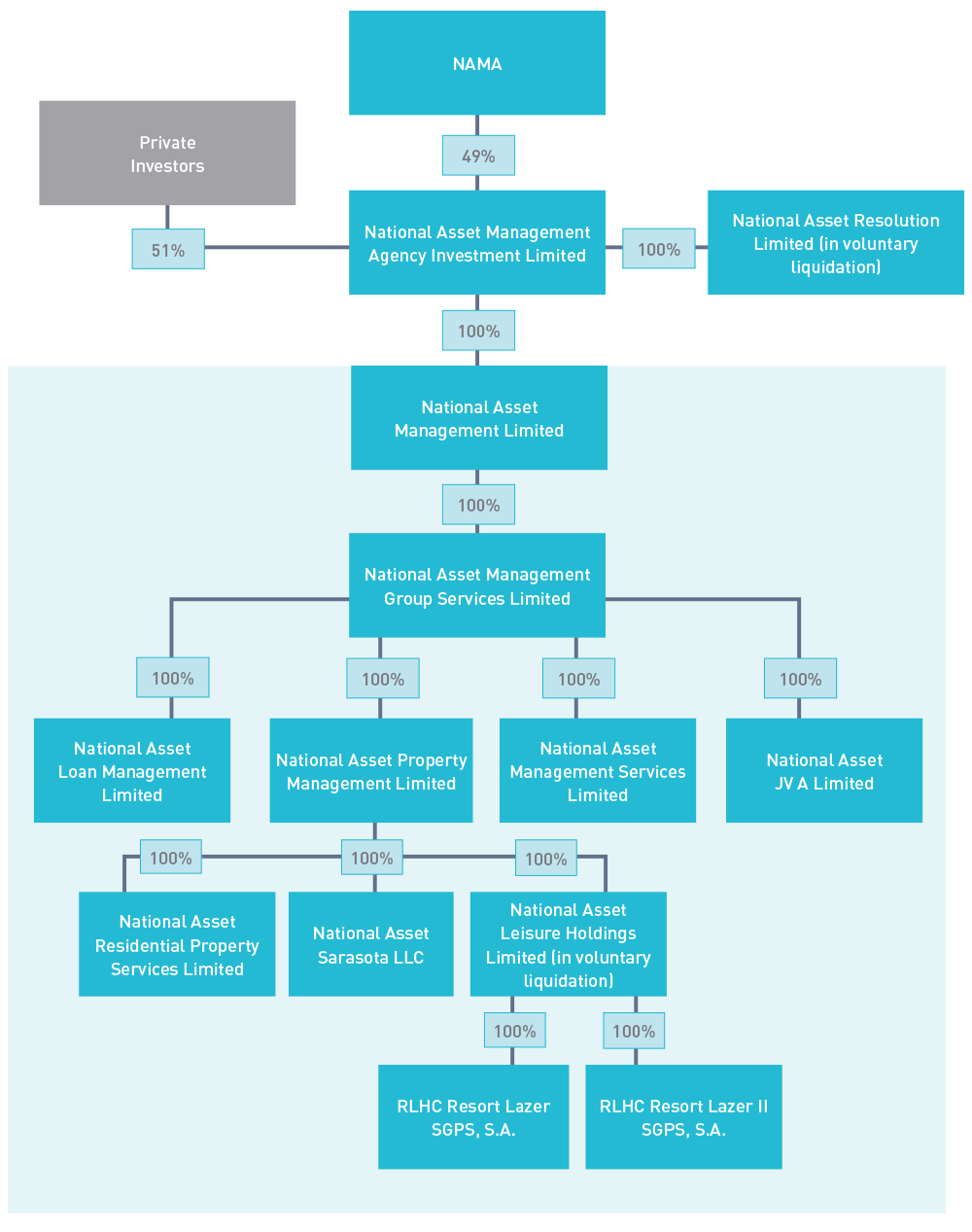

For the purposes of these financial statements, the ‘NAMA Group’ comprises; the parent entity NAMA, National Asset Management Agency Investment Limited (NAMAIL), National Asset Resolution Limited (in Voluntary Liquidation) (NARL), National Asset Management Limited (NAML), National Asset Management Group Services Limited (NAMGSL), National Asset Loan Management Limited (NALML), National Asset Management Services Limited (NAMSL), National Asset JV A Limited (NAJVAL), National Asset Property Management Limited (NAPML), National Asset Residential Property Services Limited (NARPSL), National Asset Sarasota LLC (NASLLC), National Asset Leisure Holdings Limited (in Voluntary Liquidation) (NALHL), RLHC Resort Lazer SGPS, SA (RLHC I) and RLHC Resort Lazer II SGPS, SA (RLHC II).

On 18 December 2014, NARL (in Voluntary Liquidation) and NALHL (in Voluntary Liquidation) were placed into liquidation by its members. NARL’s results from 1 January 2014 up to the date of liquidation have been consolidated into the results of the NAMA Group and are included in the consolidated income statement. As the liquidator has assumed the rights of the shareholder and now controls both of these entities and NALHL’s subsidiaries, NARL (in Voluntary Liquidation), NALHL (in Voluntary Liquidation) and its subsidiaries, RLHC I and RLHC II, are not consolidated into the results of the NAMA Group at the reporting date. For further information see Note 37.4.

The Group and the relationship between NAMA Group entities is summarised in Chart 1.

National Asset Management Agency Investment Limited (NAMAIL)

NAMAIL was incorporated on 27 January 2010. NAMAIL is the company through which private investors have invested in the Group. NAMA holds 49% of the shares of the company. The remaining 51% of the shares of the company are held by private investors.

NAMA has invested €49m in NAMAIL, receiving 49 million A ordinary shares. The remaining €51m was invested in NAMAIL by private investors, each receiving an equal share of 51 million B ordinary shares. Under the terms of a shareholders’ agreement between NAMA and the private investors, NAMA may exercise a veto over decisions taken by NAMAIL. As a result of this veto, the private investors’ ability to control the financial and operating policies of the entity is restricted and NAMA has effective control of the company. By virtue of this control, NAMA has consolidated NAMAIL and its subsidiaries and the 51% external investment in NAMAIL is reported as a non-controlling interest in these financial statements.

National Asset Resolution Limited (in Voluntary Liquidation) (NARL)

On 7 February 2013, joint Special Liquidators were appointed to IBRC under the Irish Bank Resolution Corporation Act 2013. On 11 February 2013, NAMA established a new NAMA Group Entity, National Asset Resolution Limited (in Voluntary Liquidation) (NARL). The entity was formed in response to a Direction issued by the Minister for Finance under the Irish Bank Resolution Corporation Act 2013 to NAMA to acquire a loan facility deed and floating charge over certain IBRC assets. Consideration was in the form of Government Guaranteed debt securities and cash. The debt securities were issued by NAML and transferred to NARL (in Voluntary Liquidation) via a profit participating loan facility. NARL (in Voluntary Liquidation) is a 100% subsidiary of NAMAIL.

NARL (in Voluntary Liquidation) is the senior creditor of IBRC (in liquidation), therefore funds received by the joint Special Liquidators were used to reduce the loan facility deed in the first instance. NAMA had no involvement in the liquidation process and the financial statements recognise funds received from the joint Special Liquidators and other transactions to facilitate the orderly wind up of IBRC arising from the Minister’s directions under the Act. On 22 April 2014, the Minister announced that no assets would transfer to NAMA from IBRC (in liquidation). The loan facility deed was fully repaid on 21 October 2014 and NARL (in Voluntary Liquidation) was placed into voluntary liquidation by its members on 18 December 2014.

National Asset Management Limited (NAML)

NAML was incorporated on 27 January 2010. NAML is responsible for issuing the government guaranteed debt instruments and the subordinated debt, which were used as consideration in acquiring loan assets. The Government guaranteed debt securities issued by NAML are listed on the Irish Stock Exchange.

The government guaranteed debt instruments and the subordinated debt instruments, issued in respect of the original loan portfolio, were transferred to NAMGSL and by NAMGSL to NALML. The latter used these debt instruments as consideration for the loan assets acquired from the Participating Institutions.

The government guaranteed debt instruments issued in respect of the IBRC loan facility deed were transferred to NARL (in Voluntary Liquidation). NARL (in Voluntary Liquidation) used these debt instruments as consideration for the loan facility deed acquired from the Central Bank of Ireland. The NARL senior bonds were fully redeemed in October 2014.

NAML has ten subsidiaries at the reporting date:

- National Asset Management Group Services Limited (NAMGSL)

NAMGSL acts as the holding company for its nine subsidiaries; NALML, NAMSL, NAJVAL, NAPML, NARPSL, NASLLC, NALHL (in Voluntary Liquidation), RLHC I and RLHC II.

NAMGSL was incorporated on 27 January 2010. NAMGSL acquired certain debt instruments issued by NAML under a profit participating loan (PPL) agreement, and in turn, made these debt instruments available to NALML on similar terms. NAMGSL is wholly owned by NAML. - National Asset Loan Management Limited (NALML) NALML was incorporated on 27 January 2010. The purpose of NALML is to acquire, hold, and manage the loan assets acquired from the Participating Institutions.

- National Asset Management Services Limited (NAMSL) NAMSL was incorporated on 27 January 2010. Previously a non-trading entity, NAMSL acquired a 20% shareholding in a general partnership associated with the NAJVAL investment during 2013.

- National Asset JV A Limited (NAJVAL) On 4 July 2013, NAMA established a new subsidiary, National Asset JV A Limited (NAJVAL). NAJVAL is a wholly owned subsidiary of NAMGSL. NAMA entered a joint venture arrangement with a consortium whereby a 20% interest in a limited partnership was acquired, and NAJVAL was established to facilitate this transaction. The Group is not able to exercise significant influence over the partnership as the other 80% interest is held by one shareholder who controls the decision making of the partnership. NAJVAL’s 20% investment in the partnership is recognised as an equity investment.

- National Asset Property Management Limited (NAPML)

NAPML was incorporated on 27 January 2010. The purpose of NAPML is to take direct ownership of property assets if and when required.

NAPML has five subsidiaries; NARPSL, NASLLC and NALHL (in Voluntary Liquidation), RLHC I and RLHC II: - National Asset Residential Property Services Limited (NARPSL)

On 18 July 2012 NAMA established a new subsidiary National Asset Residential Property Services Limited (NARPSL). NARPSL is a wholly owned subsidiary of NAPML, and was established to acquire residential properties and to lease and ultimately sell these properties to approved housing bodies for social housing purposes.

1,068 residential properties were delivered to the social housing sector by NAMA debtors from inception to the reporting date, of which 811 were completed and contracts on a further 257 properties (for both direct sale and through NARPSL) exchanged at the reporting date. This includes the direct sale of 443 properties by NAMA debtors and receivers to various approved housing bodies, the direct leasing of 116 properties by NAMA debtors and receivers and the acquisition by NARPSL of 252 properties for lease to approved housing bodies. - National Asset Sarasota LLC (NASLLC) On 1 August 2013 NAMA established a new US subsidiary, National Asset Sarasota Limited Liability Company (NASLLC). NASLLC is a wholly owned subsidiary of NAPML, and was established to acquire a property asset located in the US, in settlement of debt owed to NAMA. The property was sold by NAMA in December 2014; however the subsidiary will remain in existence to acquire any future US assets if required.

- National Asset Leisure Holdings Limited (in Voluntary Liquidation) (NALHL)

On 10 January 2014, NAMA established a new subsidiary National Asset Leisure Holdings Limited (in Voluntary Liquidation) (NALHL). NALHL (in Voluntary Liquidation) is a wholly owned subsidiary of NAPML and was established to acquire 100% of the share capital of two Portuguese entities, RLHC and RLHC II.

The establishment of these entities was required to facilitate the legal restructure of a number of entities with Portuguese property assets. Following the completion of the legal restructure, NALHL (in Voluntary Liquidation) was placed into liquidation. The control of NALHL (in Voluntary Liquidation) is with the liquidator who will realise the assets of NALHL (in Voluntary Liquidation). - RLHC Resort Lazer SGPS, S.A. (RLHC I), RLHC Resort Lazer II SGPS, S.A. (RLHC II) On 5 February 2014, NAMA established two new subsidiaries, RLHC Resort Lazer SGPS, S.A. (RLHC I) and RLHC Resort Lazer II SGPS, S.A. (RLHC II). RLHC I and RLHC II are wholly owned subsidiaries of NALHL (in Voluntary Liquidation) and acquired 90% and 10% respectively of the share capital of a number of Portuguese entities, following the legal restructure of the debt owed by these entities.

- National Asset North Quays Limited (NANQL)

On 8 April 2015, NAMA established a new subsidiary National Asset North Quays Limited (NANQL). NANQL is a 100% wholly owned subsidiary of NALML and was established to hold the lands acquired by NAMA at 72-80 North Wall Quay, Dublin 1 in February 2015 and to earn a secure rental income stream from the lands in the form of a fixed percentage of rent or a percentage of sales proceeds of any completed development to be built on the lands.

With the exception of RLHC I and RLHC II, the address of the registered office of each company at the reporting date is Treasury Building, Grand Canal Street, Dublin 2. Each Company is incorporated and domiciled in the Republic of Ireland, except for NASLLC, which is incorporated and domiciled in the US and RLHC I and RLHC II which are incorporated and domiciled in Portugal. The address of the registered office of RLHC I and RLHC II is Rua Garrett, n.º 64, 1200-204 Lisbon, Portugal.

Chart 1 NAMA Group